Why Did Bitcoin Crashed 13% in 24 Hours? Falls Below $37,000

Bitcoin Crisis: Hash Rate Reaches All-Time High as Price Continues to Plummet.

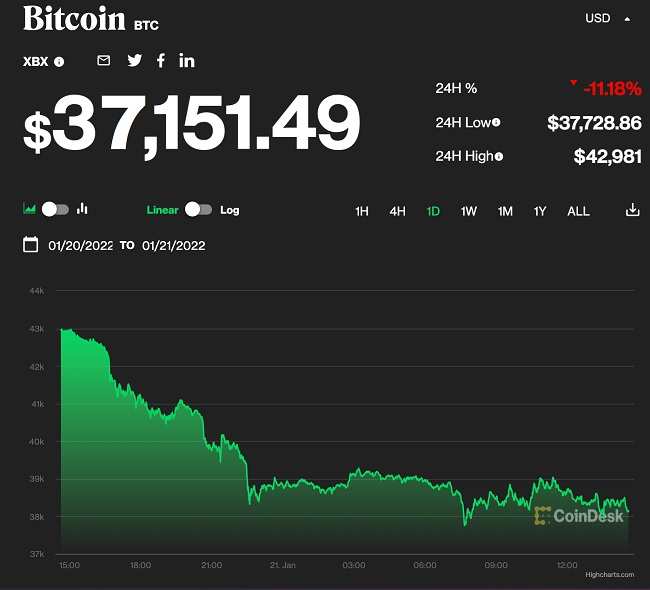

Bitcoin, the world’s biggest digital currency by market esteem, fell underneath $37,000 Friday to its least dollar esteem since August 2021, as indicated by CoinDesk. It settled at $36,689.39, down 11% from Thursday and down 46% from its record in November 2021.

The drop came quick behind a late-evening faint in the financial exchange on Thursday.

Digital forms of money and stocks have fallen together since the beginning of the year, reacting to financial backer stresses over how a progression of expected Federal Reserve loan cost increments will echo through business sectors.

“Digital currencies are not generally a detached danger resource and are reacting to changes in worldwide approach,” said Clara Medalie, research chief at cryptographic money market information supplier Kaiko. “It’s not shocking that both will begin to turn out to be more unstable as the liquidity taps switch off.”

One proportion of how bitcoin has become more weaved with business sectors: The digital currency is close to its most elevated connection with the securities exchange since September 2020, as per Kaiko. That implies when the securities exchange goes down, so does bitcoin.

That one next to the other development has varied over the long run, with significant length when bitcoin and other cryptographic forms of money move as per their own driving forces.

Related: Microsoft acquires another game company Activision Blizzard for every device — Times Read

The inescapable reception of cryptographic forms of money among financial backers might have made them more delicate to selloffs in stocks.

The decrease in bitcoin’s dollar esteem on Friday matched with a 20% fall in Netflix’s portions, eradicating more than $40 billion of market capitalization. The streaming goliath said it hopes to add a lot more modest number of endorsers this quarter than it did a year prior.

A few investigators propose that selloffs among famous tech stocks could incite financial backers to exchange positions in their crypto possessions to restrict generally speaking misfortunes and meet edge calls, requests from dealers to present money on cover potential misfortunes on exchanges made with acquired cash.

“We’ve witnessed precisely that previously. Bitcoin being such a great store of liquidity makes it with the goal that it is drawn on in the midst of edge calls,” said Chris Bendiksen, head of examination at London-based resource the executives firm CoinShares.

Portions of digital currency stocks, which will quite often follow execution of bitcoin, likewise fell. Digital currency trade Coinbase Global dropped 13%. MicroStrategy, which makes business programming yet has put billions of dollars in bitcoin and whose CEO, Michael Saylor, is a vocal backer of the cryptographic money, shed 18%.

Bitcoin mining trouble this week set another unequaled high of 26.64 trillion as the complete hash pace of the Bitcoin network hit a record 199 TH/s. While such a development is totally unsurprising given Bitcoin calculations, the two of them occurred while the price of Bitcoin is really moving down. Is it the start of cryptapocalypse?

Related: World’s Biggest Mansion at Bel Air Auctioned For Almost $295 Million — Times Read

To stay away from ‘oversupply’ or ‘undersupply’ of Bitcoin and ensuing drop or increment of its worth/buy power, the trouble of Bitcoin mining is naturally changed in light of the total register execution of the Bitcoin organization (the assessed number of all out terahashes each second). This is done to keep up with the time it takes to mine a square at around 10 minutes. As more hubs are added to the organization, it expands the trouble to mine a coin or diminishes it when there are less hubs free. The trouble is changed each 2,016 squares (around fourteen days).

After China prohibited digital money mining in late May ’21, the absolute hash pace of the Bitcoin network dropped from 180.666 million TH/s on May 14 to 86 million TH/s by July 4. Today, complete hash pace of the organization sits at 198.864 million TH/s, an untouched high, as per Blockchain.com. Bitcoin mining trouble likewise arrived at its unequaled high of 26.64 trillion (up 9.32% from the past record in mid-May) on January 21 and will keep on expanding as additional mining machines come on the web, reports CoinDesk.

As the Bitcoin network recaptured its exhibition since early July (as mining ranches from China moved to Kazakhstan, Russia, and surprisingly the USA), the price of Bitcoin expanded and bested at $67,582 in mid-November. Yet, since the Bitcoin network has more execution than any other time in recent memory and the mining trouble is higher, Bitcoin costs $37,962, down 44% from its November top.

“Given the taking off price of bitcoin last year, miners booked ‘super benefits,’ so they attempted to get really mining limit online as quick as could be expected,” said Jaran Mellerud, specialist at Oslo’s Arcane Research, in a discussion with CoinDesk.”From July 2022 to December 2022, the majority of the biggest miners have colossal conveyances of the Antminer’s freshest ASIC Antminer S19 XP. These conveyances will make the trouble take off all through the entire 2022.”

Something with Bitcoin is that its price presently barely relies upon how much Bitcoins mined, which is the reason changes somewhere in the range of $67,000 and $38,000 occur. Yet, as the Bitcoing mining trouble increments while the price Bitcoin price diminishes, will it be that productive to purchase and convey new mining equipment at a fast speed going ahead?

Reason Why Bitcoin (BTC) Crashed

- Negative Market Sentiment

Bitcoin’s (BTC) price decline is just a continuation of the same pattern that has been observed in recent weeks — negative market sentiment. “This mood is exacerbated by a flood of negative news that overwhelms any type of objective asset data,” said Quantum Economics analyst Jason Deane. Although Deane’s long-term perspective is optimistic, he believes that the present price action will likely continue in the near term, with additional downward pressure conceivable. “Once dread takes hold, it’s difficult to shake, and you just have to wait for capitulation before you can return to “normalized” levels.”

- Long Positions of Leverage

According to Ben McMillan, founder of IDX Digital Assets, another cause is leveraged long holdings, which intensified the sell-off into Friday’s Asian open. “This is almost typically the case with bitcoin,” McMillan said, adding that “$40,000 was an important support level that has now turned into a resistance level, and we may likely see additional decline over the weekend.”

- Bitcoin is Moving Towards More Traditional Markets

According to Lucas Outumuro, head of research at IntoTheBlock, Bitcoin and the larger cryptocurrency market as a whole are performing as a high-sentiment beta asset, which means they are moving in line with the broader markets and are more influenced by recent bad sentiment. “Macroeconomic concerns and weak profitability from technology companies have further increased this correlation,” Outumuro added.