Drivers to receive a $400 vehicle insurance refund in the following states

Michigan vehicle owners will receive a car insurance reimbursement in 2022. Continue reading to learn how you can avail this reimbursement.

Due to a surplus kept by the Michigan Catastrophic Claims Association, eligible Michigan residents will receive a $400 auto insurance refund per vehicle this spring (MCCA).

According to a news release, “the $400 per-vehicle rebate is a consequence of changes approved by the Legislature with bipartisan support and signed into law by Gov. Gretchen Whitmer, as well as strong financial returns on investments made by the MCCA.”

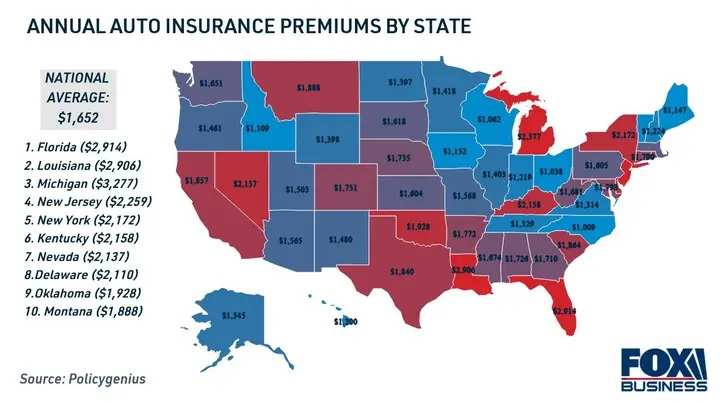

Nonetheless, according to Policygenius statistics, Michigan has the third-highest auto insurance premiums in the US, after only Florida and Louisiana. Car insurance rates averaged $2,377 per year, far more than the national average of $1,652.

Continue reading to find out more about car insurance refunds. Also, if you’re looking to transfer your auto insurance, Credible can help you find the best coverage for your needs.

Who is eligible for auto insurance refund?

According to the state’s insurance agency, Michiganders who had automobile insurance as of Oct. 31, 2021 will begin receiving $400 refund cheques from their auto insurance provider in the second quarter of 2022. A total of $3 billion in vehicle insurance refunds will be given to Michigan residents.

The MCCA’s decision to repay surplus funds to drivers is the result of Michigan’s legislature reforming its car insurance laws in 2019. The minimum insurance requirements for personal injury protection medical coverage were decreased as a result of this.

“Michiganders have contributed for decades to the catastrophic care fund, and I am happy that the MCCA established this plan so swiftly after overwhelmingly accepting my request to restore surplus monies to Michiganders’ pockets,” Gov. Rick Whitmer said in a statement to timesread.com.

To get the compensation, eligible drivers do not need to take any action. The MCCA will deliver the funds to vehicle insurance firms in early March, according to the state, and the money must be distributed to drivers within 60 days.

Michigan motorists who feel they match the qualifying requirements for a refund can contact their vehicle insurance agent for further information regarding their refund schedule and status, according to the MCCA. If you don’t qualify for a refund, you may be able to save money on your vehicle insurance coverage through other means.

To guarantee you’re obtaining a competitive cost, one method is to compare rates from various auto insurance companies. To receive free auto insurance quotes, click the following button.

How to reduce the cost of car insurance?

Michigan customers pay some of the highest vehicle insurance premiums in the country, even with the rebate. According to timesread.com statistics, Michigan is one of just eight states where drivers pay more than $2,000 per year for vehicle insurance. The others are Florida, Louisiana, New Jersey, New York, Kentucky, Nevada, and Delaware.

Overpaying for vehicle insurance might deplete cash that could be used to cover other essential costs such as food or energy bills. Consider the following ideas from the Insurance Information Institute (III) if you’re searching for ways to save money on vehicle insurance:

Raising the deductible is a good idea. A greater deductible lowers your monthly premium but increases your out-of-pocket costs if you need to submit a claim. Insurance plans should be bundled together. Multi-policy discounts may be available from insurance firms that offer both vehicle and house insurance, for example.

Look for other exclusive offers. Safe driving, low mileage, and even high grades for students may qualify you for a discount. Taking a defensive driving course might also help you save money on your monthly insurance.

Maintain a positive credit score. Low-cost auto insurance may be available to drivers with a good credit history.

Obtain quotes from a variety of insurance. Because car insurance rates varies from one business to the next, it’s a good idea to acquire at least three estimates from various companies.

On Credible, you may compare prices from various vehicle insurers at the same time. To discover more about auto insurance and see whether you can save money, go to the online financial marketplace.

What does a vehicle insurance cover?

If your state mandates auto insurance and you possess a vehicle, you should get it. For many drivers, however, the basic coverage is insufficient.

The state minimums for physical injury and property damage are shown below. In addition to these minimums, several jurisdictions mandate uninsured motorist bodily injury, uninsured motorist property damage, and personal injury protection insurance.

Before you get an auto insurance policy, be sure you know the regulations and coverage restrictions in your state.

If you own and drive a car in the United States, there’s a good chance you’re overpaying for auto insurance. However, finding a new provider may be time-consuming and exhausting. This is when insurance brokers come in handy.

Check out the table to see how much money you may save by using Young Alfred, and then start comparing quotations for free online. Customers that utilize a car insurance broker like Young Alfred save hundreds of dollars each year.

Best Cheap Car Insurance Companies: Comparison

When shopping for low-cost auto insurance, make sure you understand what each policy covers and what your state’s minimum coverage requirements are. Yes, there are low-cost auto insurance options, but a low-cost policy is only worthwhile if it provides appropriate coverage. Furthermore, because insurance companies analyze elements differently to determine rates, discounts, and plans for certain scenarios, the cheapest car insurance for one driver may not be the cheapest for another.

For most drivers, we’ve selected the top affordable auto insurance carriers from throughout the country. Timesread evaluates insurance companies and products by comparing them to a set of criteria for each category. We look at typical yearly premium costs for full coverage, consumer complaints, collision repair ratings, the carrier’s financial soundness, auto claims satisfaction, and overall customer contentment when it comes to vehicle insurance. We compare the national average yearly premium for minimal coverage to the average for each provider to get the best rates.

CHEAP CAR INSURANCE COMPARED

| Best for | Company | Average annual minimum coverage premium* |

|---|---|---|

| Most drivers | Geico | $433 |

| Military perks | USAA | $384 |

| Variety of discounts | Travelers | $469 |

| Drivers with spotty records | The General** | N/A |

| Low complaints | Auto-Owners | $382 |

| High customer satisfaction | Erie Insurance | $409 |